Hi there,

We now have quarterly subscription figures from a number of top publishers – including the NYT, WSJ, Gannett, and Lee Enterprises – providing a window into the digital subscriptions market.

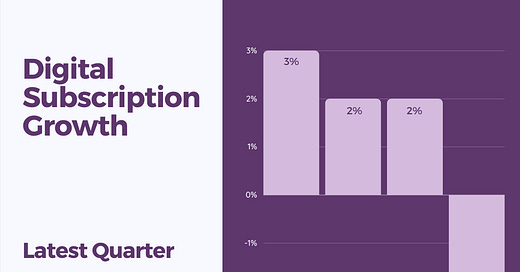

For these companies, quarter-over-quarter growth ranged between 3 and -3%. (Here we’re focusing on subscription volume, not revenue.)

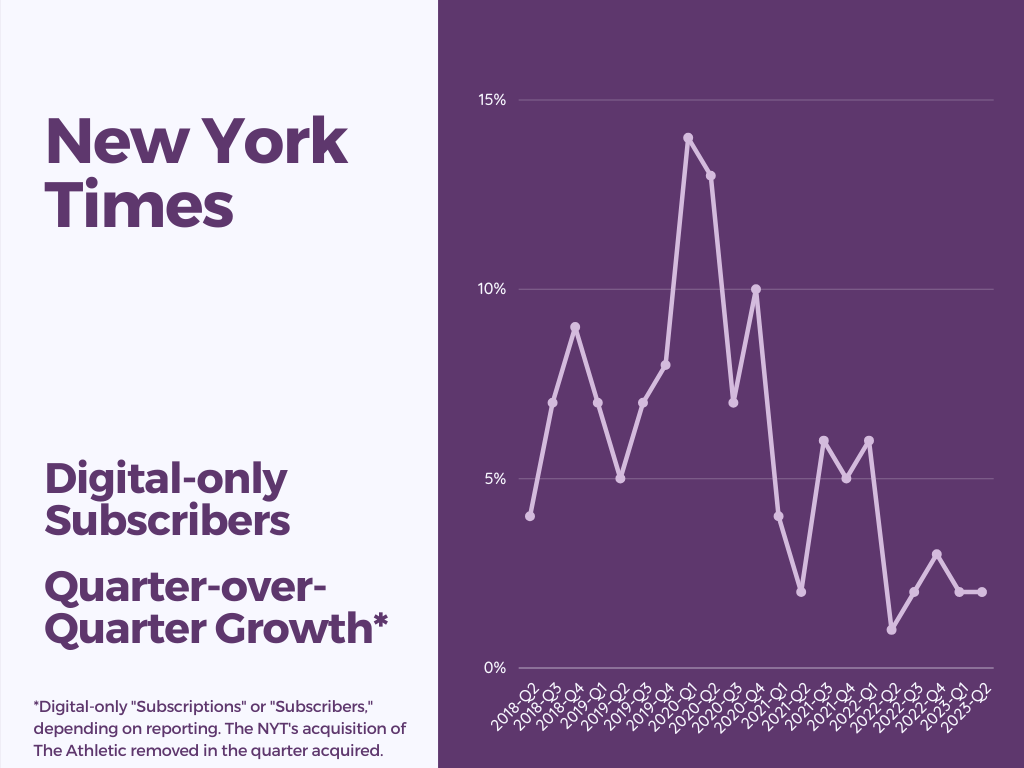

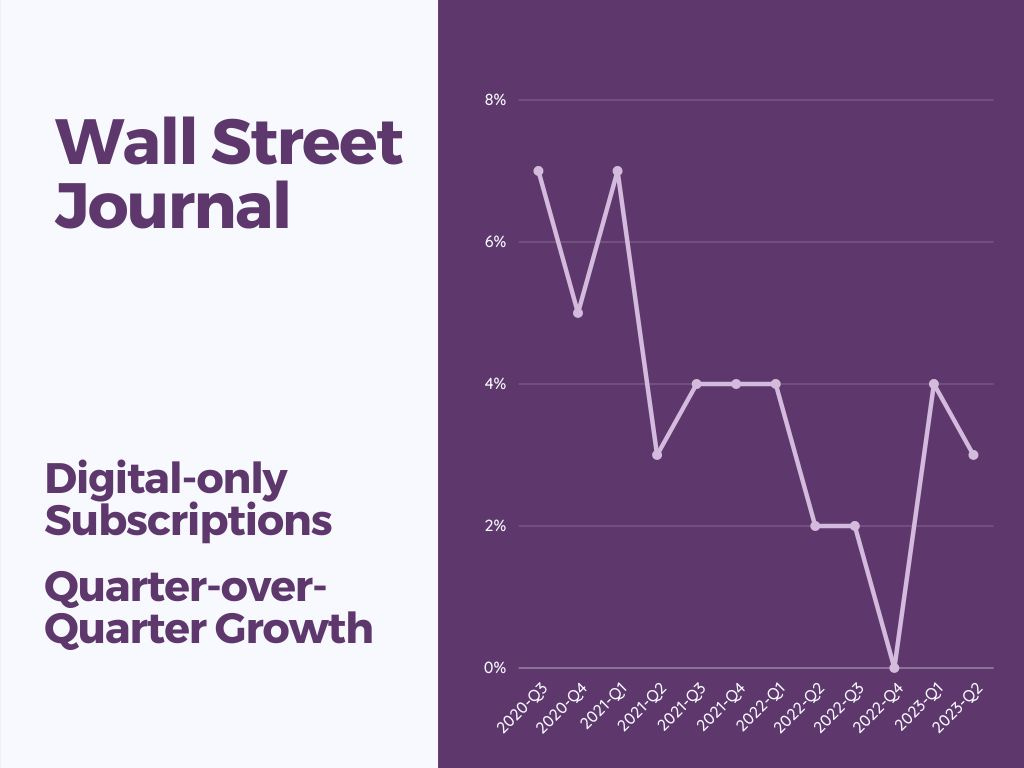

When you compare these figures to growth over the past several years, the high-level takeaway is that growth is settling into a rate well below the subscription boom times of the early pandemic, as you can see in the following graphs:

As growth rates have fallen, companies have focused on growing Average Revenue per User (ARPU). The NYT grew digital ARPU for the fourth consecutive quarter, which CEO Meredith Kopit Levien said is “a direct result of our value-based pricing strategy, which combines attractive promotional pricing, multiple subscription options and a proven ability to step up subscribers to higher prices and more products over time.”

At Gannett, CFO Doug Horne said ARPU initiatives contributed to the company’s decline in digital subscription volume.

“This reflects intentional actions to continue optimizing acquisition costs by prioritizing long-term monetization versus short-term volume. These delivered actions are paying off, evidenced by the 6% year-over-year growth in digital-only ARPU, which is the highest level in two years. ARPU is expected to continue to grow throughout the second half of 2023 as we continue to focus on customer acquisition and retention efforts on those more profitable subscribers as well as the continued optimization of our pricing strategy.”

In a future post, I’ll dive further into these companies’ ARPU strategies.

To go deeper on earnings, here are links to the quarterly releases from each company: NYT // WSJ // Gannett // Lee.

And here’s the latest news in digital media:

Police raided a local county newspaper. The police defended their actions, and owner & publisher Eric Meyer gave a Q&A saying the paper had been investigating allegations of sexual misconduct against the chief of police.

News Corp’s earnings:

Ad revenue at Dow Jones, which includes WSJ, fell 6% YoY (on an apples-to-apples basis).

Ad revenue at the News Media division – which includes the New York Post, News Corp Australia, and the Sun – fell 7% YoY (on an apples-to-apples basis).

The NYT…

Opted against joining a coalition of publishers that would jointly negotiate with AI companies.

Updated its terms of service to prohibit use of their content to train AI systems.

Plans to ask managers to incorporate in-office attendance into performance evaluations.

M&A:

5-Hour Energy Founder Manoj Bhargava will acquire a majority stake in Arena Group, adding to his collection of media assets.

The owner of the Daily Mail is in talks to acquire The Daily Telegraph.

More on publishers:

CoinDesk laid off 45% of editorial staff.

Blendle is shutting down micropayments in favor of subscription bundles.

Vice Media owes back taxes for Refinery29, according to the IRS.

The Evening Standard lost £16m in 2022.

A newsletter from The Verge gives special design treatment to important links.

Platforms:

Threads usage is down 79% – DAUs are now around 10 million, compared to X’s more than 100 million.

X CEO Linda Yaccarino gave an interview clarifying the company’s direction.

Interesting reads:

A profile of Barstool CEO Erika Ayers Badan.

A feature on Rappahannock News, a community paper with 2,100 paying subscribers in a county of 3,800 households.

A deep dive on how printing press closures are challenging local papers.

A case study on how a nonprofit local newsroom collaborated with a local university to cover the fallout of wildfires.

A CJR piece about Forbes.

A review of Q2 earnings at iHeartMedia, Spotify, and Acast.

A roundup of how BuzzFeed is using AI.

Thanks for being a part of Business Side’s public beta. Have a great day!

Was this forwarded to you? Subscribe here.